OUR Business Model

CHALLENGE

your objectives and constraints

BUILD A MODEL

of your personal and

corporate finances

RECOMMEND

personalized solutions

ESTABLISH

your Integrated Financial Plan

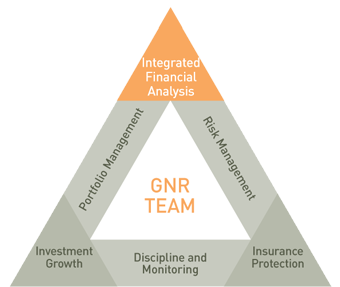

In order to respond to your objectives, our Integrated Financial Analysis offers an overall vision that is easy to follow and understand. GNR assures you top quality services in each of these fields, all of which are essential for organizing your present situation and building your future. These services are offered directly from our firm or through our network of professionals.